Once upon a time, Demigods who were once human later became deities. Earning demigod status meant you had to qualify through levels of predefined categories: looks, ability to go to war, wisdom, and fortitude. So it is now, the modern day deities of Mark Zuckerberg, Jeff Bezos, and Elon Musk, who are worshipped not for their looks but for the empires they have built that have yielded them a combined net “worth” of just under half a trillion dollars. This comes as both the American dream realised but also a cautionary tale for Entrepreneurs everywhere – that there is less of you.

The number of tech startups — from software to computer system design companies — has grown about 20% since 2007 but that sector represents just 2% of the roughly 6 million companies in the United States. The obstacles for would-be startups are slowing the formation of innovative businesses – and that’s going to have a major impact when the elevator gets sent back down.

Disruptive innovation with the full embracement of the digital age across most continents shows where the seed capital is going. Bio-medical and pharmaceutical industries have always been home to extravagant investment and so showed little difference. Then there’s the ‘convenience’ technologies such as Uber, Airbnb, and Netflix, where “the winner takes all” has come from. But this impact is in the hands of the very few, and in comparison to the number of businesses that are founded it’s brutally unequal, at the extreme of Parato’s law, where competition is crushed or absorbed by the free flowing venture capital dollars into the select favourites.

Up to 60% of US investments now go to internet companies. The dissemination speed of new fads could be considered partly to blame. Two minutes ago, the world was launching Angry Birds, then it was looking for virtual Pokémon and now China has provided TikTok – 60 seconds of looping video to keep the attention long enough to gain 1.5 billion users since 2017. The rapid, up-scalable potential of new technology and return on investments makes almost every other industry look pedestrian in comparison – but there is so much more to bringing ideas to the world than just tech.

Winner takes all

In conjunction with the amassing of wealth is the increasing size of dominant market players. The economic power cast by the giants of industry all but eliminates the growth of modest start-ups. Most industries now have just a few enormously popular providers and even fewer minor stakeholders. To put it simply, ‘competition is for losers’. It is most obviously evident in Google search results. Input a small brand or store and survey the results…paid advertising campaigns of large competitors everywhere. The hunger to eat up the entire market creating oligopolies is a strategy permeating every tech investment at seed on. The US economy will grow by 2.2% this year, representing approximately $472 billion in additional goods and services produced. In the last 12 months, Amazon, Apple, Facebook, Google, and Microsoft have added $1.6 trillion to their market cap combined.

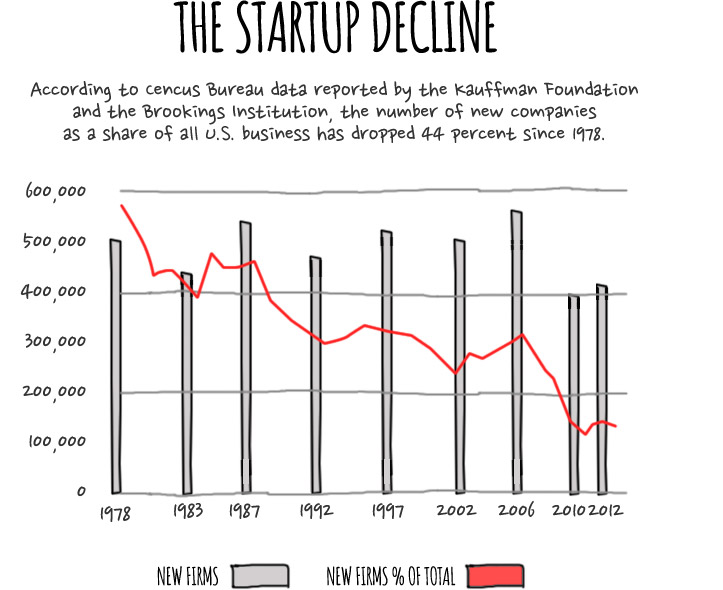

Much of this capture comes at the cost of small and medium-size firms. Small business formation is at a multi-decade low despite the NASDAQ meteoric rise of 30% in the last 12 months. The fastest-growing sectors receive scant funding from investors, who know better than to back young companies looking to compete with unregulated monopolies.

And even in tech, they no longer invest from the start. Seed capital is diminishing and discouraging entrepreneurs. Most start-ups don’t get a look in until they are established entities looking to grow. In 2014, VC firms invested $48 billion in deals, the most since 2000. But professional investors have showered more love on mature companies than on infants. Research by Mattermark, which tracks startup data, shows that between 2005 and 2014 the size of seed investments made by VCs stayed flat. The size of C, D, and E rounds, by contrast, roughly doubled. The number of small seed rounds has recently dropped, according to PitchBook, with investments below $500,000 declining 61 percent between the first quarter of 2013 and the fourth quarter of 2014. Below the VC level, angels and seed funds have proliferated as startup costs have decreased. But even angels’ interest is down. And when investment is done, then there are less entrepreneurs, less ideas, and worse, less competition.

Where to now?

The last proper recession had epicentres in Europe and North America with the reverberations being felt less and less the further from those you got. The likelihood of the next one – coronavirus resultant – is likely to be more widespread. Add to this the impact of the US presidential election, and other global power elections, and everything seems a lot more uncertain from an entrepreneurial view.

But the reverse is true. Significant change and discomfort leave global populations having to adapt to ‘the new’ all the time. It creates pain points, problems and seemingly makes lives harder. What were the basic enterprise principles? Solving problems and making lives easier. The simplest essence of entrepreneurship is to offer solutions to problems and meet a need. The world will soon be demanding new innovative solutions and start-ups will have an agility advantage. Investment capital and stimulus packages will likely remain available so it becomes a race to see who can produce the solutions the fastest.

A mass migration to the remote world explored the avenue of keeping business this way for multiple economies. It also unleashed the potential to hire contractors from anywhere rather than those that can attend in-person. Coupling all of this with the reduction in job security and the popular gig economy, the ultimate micro-entrepreneurs, of soloists/sole proprietors and you just might have the conditions for a new kind of entrepreneurship.